Consensus 2021: 6 Questions for Gartner's Avivah Litan

Avivah Litan, a distinguished analyst at Gartner Research, meets Dan Kuhn to discuss how enterprises can (and won't) use blockchain tech.

Avivah Litan is a distinguished analyst at Gartner Research specializing in emerging technologies. She has deep insight into everything from enterprise blockchain to the buzzy world of non-fungible tokens (NFT). CoinDesk sat down with her to discuss what’s latest in emerging tech.

You've written and advised clients on enterprise blockchain. Where does enterprise blockchain stand now that Microsoft Azure has decided to shut down its blockchain department? Does this signify anything for IBM or ConsenSys' experiments?

Blockchain as a Service (BaaS) is not an area where enterprises need the most help. BaaS addresses the easiest part of blockchain implementation, i.e. provisioning and operating nodes, and related basic services. Instead, enterprises need help aligning their use cases and business ecosystems with blockchain distributed ledger technology. Most users are not clear on why they need the technology.

The value of permissioned blockchain is hard to understand since it does not implement the most revolutionary aspect of public blockchains – i.e., trust minimization and elimination of central authority, achieved via decentralized consensus. Instead of eliminating central authority, permissioned blockchain replaces it with task force authority managed by consortia. Task forces are good at producing studies and academic papers but often fail at getting projects implemented. Too many cooks in the kitchen translates to competing priorities and budgets.

Several blockchain service providers add application services on top of basic infrastructure services, making them more useful to enterprises than just basic BaaS. These services include Kaleido and ConsenSys Quorum (Ethereum based). In fact, Microsoft suggested its BaaS users consider Quorum as an alternative to their dying service. But the problems inherent to task force management and group governance are never going to go away, no matter how great the blockchain technology services are. Companies simply do not want to give up control. If anything, they want to usurp more of it. The simple answer is to recognize this fact – central authority is here to stay in the enterprise. But that doesn’t mean centralized organizations cannot embrace decentralized applications wrapped by their centralized services.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindeskuat/MGM76HCWFFGHLAYT7SEIPPPI4M.jpg)

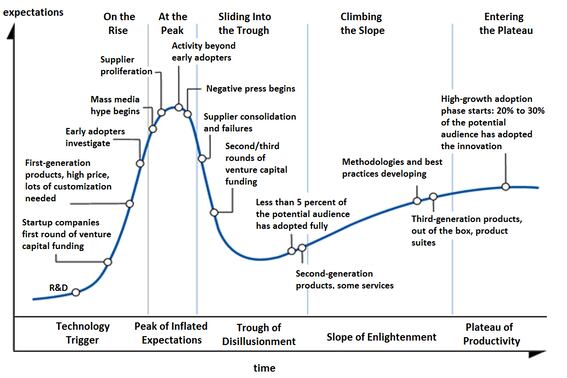

In the meantime, there is real business value in enterprise blockchain so long as all participants agree to the terms of participation. Our 2020 survey showed that about 14% of projects made it into production (see Blockchain Trials Show Business Executives Drive Focused Solutions to Production), but even then transaction volume is limited. The promising enterprise blockchain use cases we identified and documented are still in early stages, mainly because of process and governance issues and not because of technology. Project participants are often stuck in those areas, and access to BaaS infrastructure services is the least of their concerns and won’t help them get unstuck.

What do you make of China's Blockchain-Based Services Network (BSN)? Is this a legitimate model for enterprise blockchain going forward?

It looks like a well thought out, easy to use and cheap service if all you want are infrastructure services. It's interesting how they only allow international customers on the public permissionless blockchains, but won’t let their Chinese customers use them. In any event, I wouldn’t advise any of our clients to use BSN because of privacy and confidentiality issues – it would be hard to trust.

Major corporations like ING Bank and Bank of America discussing the disruptive potential of decentralized finance. Is this how crypto penetrates the mainstream ... by getting folded into a banking app?

Centralized companies like banks and insurance companies must determine how to add value, protections and new revenue streams to DeFi while their legacy businesses are cannibalized by decentralized protocols and contracts. DeFi technology also needs to mature, and the user experience needs to markedly improve. This transition will inevitably happen. We already see this trend unfolding during recent Gartner client inquiries. The future of enterprise blockchain includes centralized protection services and products wrapped around decentralized apps.

It will take three to five years to come to fruition, but it will combine the best of both worlds – new school innovations with old school protections, such as KYC, custodial services, fraud detection, escrow services and more. At that point, many standalone enterprise blockchains will morph into CeDeX (Centralized Decentralized Everything) environments.

The use of ransomware is increasing and increasingly profitable. Many seem to suggest that crypto's open access and semi-anonymous design is part of this growing problem. Is that true? What would increased surveillance or the presence of law enforcement mean for the blockchain industry?

Law enforcement can already look at all the bitcoin transactions used for ransomware. They have a better chance catching the criminal if they get paid in bitcoin than if the criminal uses the opaque banking system transfers and launders the money through mule accounts. Increased law enforcement analysis of blockchain transactions alone (without subpoenaing centralized exchange records) should not be an inhibitor to blockchain growth and innovation. On the other hand, more regulation on [know your customer] and [anti-money laundering] at exchanges will not be positive for innovation and will likely not do that much in catching bad actors.

Look at how far KYC and AML has not taken us in preventing criminals from using the banking system for nefarious activities.

Are there any consumer-level privacy/data preserving tools or online hygiene techniques you might recommend?

Certainly we advise to keep all sensitive data off-chain and use ZKPs or hashes of linked data (and other methods) if information must be linked to blockchain operations and functions.

What do you think of $DESK? Does tokenization have any promise for media companies or in the fight against mis/disinformation?

I didn’t check it out but I am a big believer in using blockchain to track provenance of information akin to a whitelist. I’ve written on that and can send you more info if you want to see it. You also have to detect misinformation along with whitelisting good information on blockchains since most information will not be whitelisted (so that provenance can be tracked). You need a layered approach that includes misinformation detection to cover the entire population of information out there.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindeskuat/SSHTKOB2JFCGZJSIKMBKVWKXLA.jpg)

/arc-photo-coindeskuat/arc2-prod/public/HT2WEUWHWBFFXOMSGZOC4MCHMQ.png)